Examining the historic course of the market, we see the initial phase of mass industrial development cumulating in a global crisis in the 1930s - with the problem of overproduction caused by a decrease in the rate of industrial profits. To understand why capitalism falls into depression, we should look to Das Kapital. Marx in his main work identified what he called (the tendency of the rate of profit to fall) as being central to the expansionary dynamic of the capitalist system - it is both the cause of periodic crisis and main agent of growth.

First highlighted in capital volume 3, he notes ''the gradual growth of constant capital in relation to variable capital must necessarily lead to a gradual fall of the general rate of profit, so long as the rate of surplus-value, or the intensity of exploitation of labor by capital, remain the same.'' Marx 1894. In other words, capitalists through the process of competition are required to invest ever higher amounts in the technological upgrade of their productive facilities, as a consequence of this increased expenditure they see an overall reduction in the rate of returns - so long as the rate of production/cost of labor remains stable. In order to overcome this problem capitalists may place downward pressure on the social wage or seek cheaper labor markets/resources to exploit through expansion. The former strategy generally leads to a decline in aggregate demand thereby exasperating the situation; the later provides a more steady solution - if entirely temporary.

This is precisely what occurred during the great depression. The US had undergone a reduction of 40% in its rate of profit between the 1880s and the 1920s proceeding the great depression. ''Real wages only rose 6.1% between 1922-1929. The discrepancy was greatest in 1928 and 1929, with output rising three times faster than consumption.'' Harmen (2009). Demand fell relative to supply and crisis of overproduction/underconsumption ensued, food/goods where allowed rot while millions of workers stood idle alongside unemployed capital. Demand in the real sense of the word existed of course - people straving and exhibited high demand for food, however in economic terms there was no ''demand'' considering people where unable to purchase.

In the end the US offset the crisis through the initiation of stimulis, large public works programs where enacted - the aim was to create jobs so as to increase the amount of money in circulation. The main objective was to encourage consumer spending so as to sure up investment in productive enterprise. These policies where enacted as part of Roosevelts - New Deal. Rather than attempting to close the deficit - and deflate the economy, it was decided to drasticly increase spending. It did, for a time offset crisis and generate massive growth.

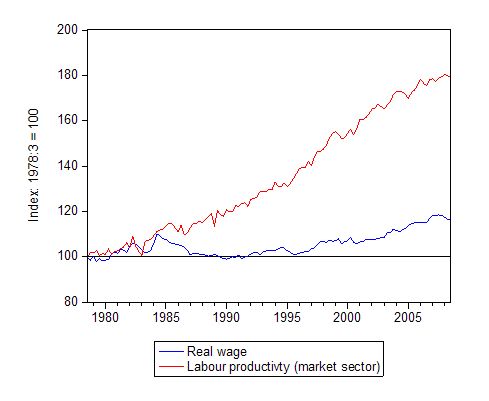

The problem again emerged in the late 70s, however rather than alleviate the crisis through fiscal expansion another tactic was enacted, namely the transfer of investment from industry to finance, conjoined with a large scale assault upon organized labor. In the case of US finance, Harvey notes ''The total daily turnover of financial transactions in international markets, which stood at $2.3 billion in 1983, had risen to $130 billion by 2001. The $40 trillion turnover in 2001 compares to the estimated $800 billion that would be required to support international trade and productive investment flows'' Harvey p.161 (2005). Allen summarizes how this led to a partial recovery, considering that ''In the US, the rate of profit rebounded by 3.6% between 1979 and 1997, after it had fallen 5.4% from 1966-1979, Fred Morseley calculated that it had recovered about 40% of its earlier decline'' Allen p.101 (2008). Downward pressure was also placed upon wages within the industrialized world, so for example in the US ''Since 1973 total productive growth has risen by 83% while the overall compensation package for workers rose only by 9%'' Allen p.99 (2008).

The problem again emerged in the late 70s, however rather than alleviate the crisis through fiscal expansion another tactic was enacted, namely the transfer of investment from industry to finance, conjoined with a large scale assault upon organized labor. In the case of US finance, Harvey notes ''The total daily turnover of financial transactions in international markets, which stood at $2.3 billion in 1983, had risen to $130 billion by 2001. The $40 trillion turnover in 2001 compares to the estimated $800 billion that would be required to support international trade and productive investment flows'' Harvey p.161 (2005). Allen summarizes how this led to a partial recovery, considering that ''In the US, the rate of profit rebounded by 3.6% between 1979 and 1997, after it had fallen 5.4% from 1966-1979, Fred Morseley calculated that it had recovered about 40% of its earlier decline'' Allen p.101 (2008). Downward pressure was also placed upon wages within the industrialized world, so for example in the US ''Since 1973 total productive growth has risen by 83% while the overall compensation package for workers rose only by 9%'' Allen p.99 (2008).

Decrease in the rate of profit - offset through the de-regulation of the Regan era which opened up new sources of accumulation and supressed wages.

The financialization of the market - money being transfered from productive capital, to speculative activity, such as the trade on debt/derivitives ect.

Wage stagnation, due to the defeat of organized labor. Unlike the Keynsian era, wages under the neo-liberal regime do not rise in line with increased productivity.

In order for the aforementioned process to be enabled however, regulatory laws needed to be reformed and in many cases abolished, liberal ideology according to Harvey was utilized as the political justification for the enactment of capital/labor de-regulation. There existed a structural requirement to de-regulate the market and it was facilitated by a shift in political trajectory. This occured both within national governmental spheres and global regulatory bodies such as the IMF/WTO. Stiglitz summarizes that ''In the early 1980s a purge occurred inside the World Bank'' he continues to explain how after the appointment of Ann Kruger as chief economist in 1981 ''Free markets where seen as the solutions to the problems of developing countries''. In response to this shift towards neo-classical ideology many economists left the organization.

On the issue of poverty, one of the central questions concerning developmental economists, political theorists, anthropologists and sociologists alike is, does capitalist globalization of the post Keynesian era deliver on its own terms? Has the period of market liberalization provided an increase in the absolute living standards of the majority? The theoretical premise on which market liberalization was advocated held that liberal economic policy would invariably lead to higher productive output, more profits, cheaper goods and higher living standards. However some years on we see a very different picture having emerged as "The poorest group went from a per capita GDP growth rate of 1.9% annually in 1960-80, to a decline of 0.5% per year (1980-2000). For the middle group (which includes mostly poor countries), there was a sharp decline from an annual per capita growth rate of 3.6% to just less than 1%. Over a 20-year period, this represents the difference between doubling income per person, versus increasing it by just 21%." McKay p.329 (2007).

The structural adjustment programs imposed by the IMF and World Bank have in many cases exposed poorer nations to advanced competition through the maintenance of protectionist policies within the developed sphere. As conveyed by former Chief economist of the World Bank Joseph Stiglitz ''The western countries have pushed poor countries to eliminate trade barriers, but kept up their own barriers, preventing developing countries from exporting their agricultural products and so depriving them of desperately needed export income'' Stiglitz p.6 (2004) . Oxfam highlights in a 2003 report that ''in 2002, India paid more in tariffs to the US government than Britain did, despite the fact that the size of its economy was less than one third that of the UK - Bangladesh paid almost as much to the US government as France despite the fact that the size of its economy was only 3% that of France'' Chang p.75 (2007). The reality of neo-liberal policy is often hidden through the misrepresentation of figures and ''obscured by the observation that conditions have generally improved under the neo-liberal regime, or by resort to a concept of ''globalization'' that muddles export orientation with neo-liberalism, so that if a billion Chinese experience high growth under export oriented policies that radically violate neo-liberal principals, the increase in average global growth rates can be hailed as a triumph for the principals violated'' Chomsky p.217 (2007).

The structural adjustment programs imposed by the IMF and World Bank have in many cases exposed poorer nations to advanced competition through the maintenance of protectionist policies within the developed sphere. As conveyed by former Chief economist of the World Bank Joseph Stiglitz ''The western countries have pushed poor countries to eliminate trade barriers, but kept up their own barriers, preventing developing countries from exporting their agricultural products and so depriving them of desperately needed export income'' Stiglitz p.6 (2004) . Oxfam highlights in a 2003 report that ''in 2002, India paid more in tariffs to the US government than Britain did, despite the fact that the size of its economy was less than one third that of the UK - Bangladesh paid almost as much to the US government as France despite the fact that the size of its economy was only 3% that of France'' Chang p.75 (2007). The reality of neo-liberal policy is often hidden through the misrepresentation of figures and ''obscured by the observation that conditions have generally improved under the neo-liberal regime, or by resort to a concept of ''globalization'' that muddles export orientation with neo-liberalism, so that if a billion Chinese experience high growth under export oriented policies that radically violate neo-liberal principals, the increase in average global growth rates can be hailed as a triumph for the principals violated'' Chomsky p.217 (2007).

Additionally there exists the issue of increasing third world debt ''The debt of the developing world, for example rose from $580 billion in 1980 to 2.4 trillion in 2002. In 2002 there was a net outflow of 340 billion is servicing, compared to overseas development aid of $37 billion'' Harvey p.193 (2005). Repatriated profits expropriated from peripheral economies conjoined with massive outflows in debt service constitute a form of upward re-distribution indicative of the neo-liberal system. However although the process of upward re-distribution may have intensified under the post-Keynesian regime, it did exist prior to the shift in trajectory, albeit to a lesser extent - Zinn for example notes that US corporations between 1950 and 1965 ''in Latin America invested 3.8 billion and made 11.2 billion in profits, while in Africa they invested 5.2 billion and made 14.3 billion in profits'' McKay p.389 (2007). What is often called the ''anti-globalization'' movement is largely anti-capitalist, moreover it is more specificly opposed to ''neo-liberal globalization''.

Neo-liberal market reform has invariably resulted in the increased accumulative capacities of the global bourgeoisie, whilst weakening the working class within all spheres of production. It would be incorrect however to assume that Keynesian capitalism is consistent on an internal level. Employment was high under Keynesianism, so as a consequence of increased unionization - wages increased in line with productive output. Capital in response, offset costs in the form of increasing prices to the extent that aggregate demand declined and inflation increased. Inflation provided the justification required for the neo-liberal/monetarist ascendancy. Capitalism as a socio-economic system is wrought with an internal contradiction between its requirement to accumulate surplus value, and its capacity to generate it. This contradiction is both the cause of periodic crisis and the source of a vast productive and expansionary dynamic.

Good post, illustrates the cynicism of those who present a system which doesn't even work on its own terms as the only show in town.

ReplyDelete